BANK OF THE JAMES FINANCIAL GROUP (BOTJ)·Q4 2025 Earnings Summary

Bank of the James Hits Record Earnings, Crosses $1B in Assets as Margins Expand

February 4, 2026 · by Fintool AI Agent

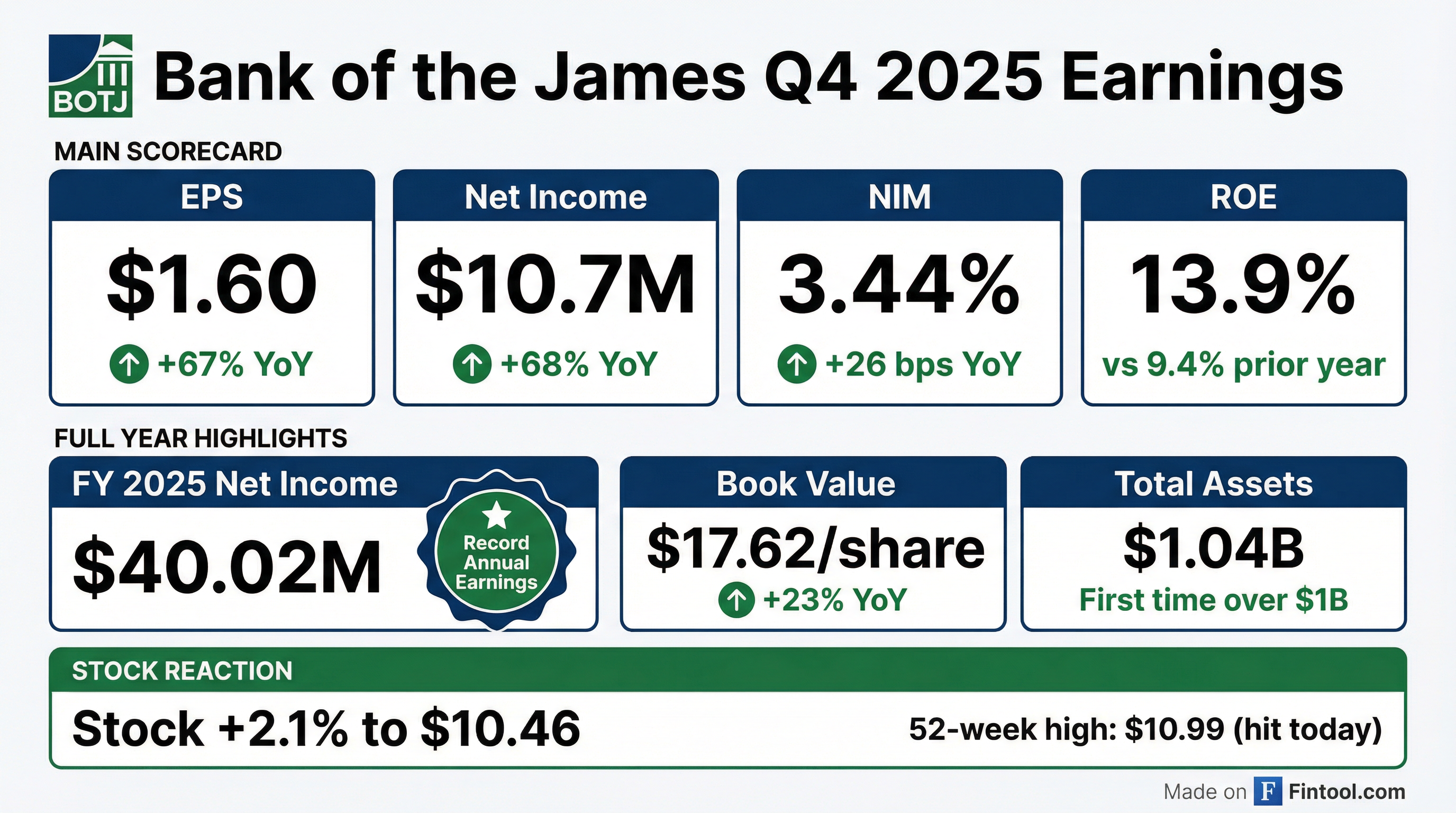

Bank of the James Financial Group (NASDAQ: BOTJ) delivered record annual earnings and crossed the $1 billion asset threshold for the first time, marking a transformational quarter for the Virginia-based community bank. Q4 2025 EPS surged 67% year-over-year to $0.60 as net interest margin expanded and the efficiency ratio improved dramatically.

Did Bank of the James Beat Earnings?

BOTJ is a small-cap community bank (~$93M market cap) with limited sell-side analyst coverage, so there is no consensus estimate to compare against. However, the quarter-over-quarter and year-over-year improvements were substantial:

Source: Company 8-K

For the full year, BOTJ reported record net income of $9.02 million ($1.99 EPS), up 13.6% from $7.94 million ($1.75 EPS) in 2024.

What Changed This Quarter?

Three key drivers powered the earnings surge:

1. Net Interest Margin Expansion

Net interest margin expanded to 3.44% in Q4 2025 from 3.18% a year earlier, as the bank successfully managed deposit pricing while maintaining loan yields. Full-year net interest income grew 12.2% to $32.81 million.

2. Interest Expense Reduction

Total interest expense declined 12.1% in Q4 to $3.47 million, driven by the retirement of approximately $10.05 million in capital notes at the end of Q2 2025 and active management of deposit pricing in a moderating rate environment.

3. Expense Discipline

Noninterest expense declined 4.2% in Q4 to $9.11 million as vendor renegotiations reduced data processing costs and professional fees dropped. The efficiency ratio improved dramatically to 70.81% from 82.62%.

What Did Management Say?

CEO Robert R. Chapman III highlighted the operational execution:

"We had record annual earnings of $9.02 million in 2025, up 13.6% from 2024. Margin improved as we managed deposit pricing and loan yields, and interest expense declined after we retired approximately $10.05 million in capital notes earlier in the year."

President Mike Syrek emphasized the cost focus:

"On the expense side, vendor renegotiations and lower professional fees reduced fourth-quarter noninterest expense, and we expect those savings to continue into 2026. Our efficiency ratio improved dramatically throughout the year, reflecting the progress we've made on the expense side."

Balance Sheet: $1 Billion Milestone

BOTJ crossed the $1 billion asset threshold, finishing 2025 with $1.04 billion in total assets—up 6.1% from $979 million at year-end 2024.

Source: Company 8-K

The bank grew loans without compromising credit standards, as the allowance for credit losses declined to $6.45 million from $7.04 million. Nonperforming loans remained minimal at 0.26% of total loans.

Wealth Management Contribution

Pettyjohn, Wood & White (PWW), the bank's SEC-registered investment advisory subsidiary, generated $5.35 million in wealth management fees in 2025, up 10.4% from $4.84 million in 2024. PWW contributed approximately $0.38 per share to earnings.

How Did the Stock React?

BOTJ stock rose 2.1% to $20.46 on earnings day, hitting a new 52-week high of $20.99 intraday. The stock has rallied significantly over the past year:

- 52-week high: $20.99 (hit today)

- 52-week low: $12.75

- 50-day average: $18.26

- 200-day average: $15.68

The stock now trades at 1.16x book value ($17.62 book value per share), reasonable for a community bank generating nearly 14% ROE.

Historical EPS Trend

BOTJ's earnings trajectory over the past 8 quarters shows the recovery from a weak Q1 2025 and the strong finish to the year:

Q4 2025 data from company 8-K ; Prior quarters from S&P Global

Q1 2025 was notably weak, but the bank recovered strongly with three consecutive quarters above $0.59 EPS.

Forward Outlook

Management signaled continued focus on the same operational levers in 2026:

- Pricing discipline: Continue managing deposit pricing and loan yields to maintain margin

- Expense control: Expect data processing and professional fee savings to persist

- Credit quality: Maintain underwriting standards despite loan growth

- Efficiency: Further improvement in efficiency ratio remains a key focus

The bank did not provide specific numeric guidance.

Key Risks

- Interest rate sensitivity: Margin expansion benefited from the rate environment; a sharp shift could pressure NIM

- Concentration risk: Primarily serves central Virginia markets; local economic weakness would impact performance

- Small-cap illiquidity: Low trading volume (1,870 shares today) limits institutional participation

- Limited analyst coverage: No sell-side coverage means less price discovery and higher information asymmetry

Bottom Line

Bank of the James delivered on all fronts in Q4 2025—record earnings, margin expansion, expense control, and a $1B asset milestone. The stock's 2% pop to a 52-week high reflects the strong execution. At 1.16x book value with a 14% ROE and growing book value, the valuation appears reasonable, though limited liquidity and analyst coverage remain constraints for larger investors.

Data sourced from Bank of the James Financial Group 8-K filed February 4, 2026, and S&P Global.